The future of your business is our business

Transactions

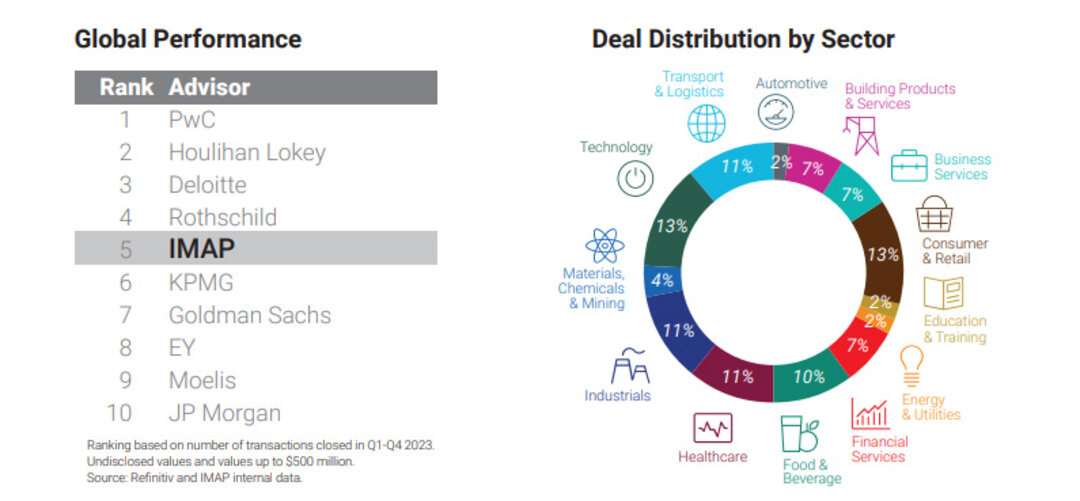

IMAP is consistently ranked in the top 10 middle market M&A advisories worldwide

IMAP PROVIDES INDEPENDENT STRATEGIC M&A AND CORPORATE FINANCE ADVICE.

We are the gateway to global middle-market M&A. Our cross-border experience extends across Europe, the Americas, Asia, the Middle East, and Africa.

Countries

Deals closed 2023

IMAP Professionals Worldwide

$BN transaction value 2023

WHAT WE DO

IMAP PROVIDES INNOVATIVE AND QUALITY-DRIVEN M&A AND CORPORATE FINANCE SERVICES. We offer:

01

Sell-side advisory

We invest time in understanding your goals to craft the most effective plan for your sale, succession, or divestitures. A headache-free process. The perfect fit buyer. The optimal deal.

02

Buy-side advisory

Strategically creative expansion and growth advice. Identify and acquire the ideal target, at the best price, with a seamless transition. Benefit from our privileged access to sellers and industry specialists across the world.

03

Debt & Equity Capital Advisory

The range of options for raising capital and equity is vast, complex, and ever-changing. IMAP experts have the contacts and deep knowledge to turn liquidity and refinancing challenges into long-term strategic success.

04

Corporate Finance advisory

We complement our M&A management with corporate finance services, from pre-sale preparation to post-merger integration, to consulting on strategy, valuation and restructuring. For a 360º approach to consistent growth.

covering all major sectors

Industries

Automotive

Building products & services

Business services

Consumer & retail

Education & training

Energy & utilities

Financial services

Food & beverage

Healthcare

Industrials

Infrastructure

Materials, chemicals & mining

Real estate

Technology

Transport & logistics

Our business is your business growth